In examining the evolution of upstream petroleum contracts, the fiscal regime is one of the main distinguishing features among different contractual frameworks.

Across all contractual models used in Iran to date—from early concession agreements, to pre-revolution production sharing contracts, and later to various forms of service contracts adopted after the revolution (beginning with the first generation of Buyback contracts, later modified into what are known as the second and third generations), and finally the new Iran Petroleum Contract (IPC) framework introduced by the Cabinet of Ministers in 2016 (1395)—changes in the fiscal regime have always been among the most significant elements.

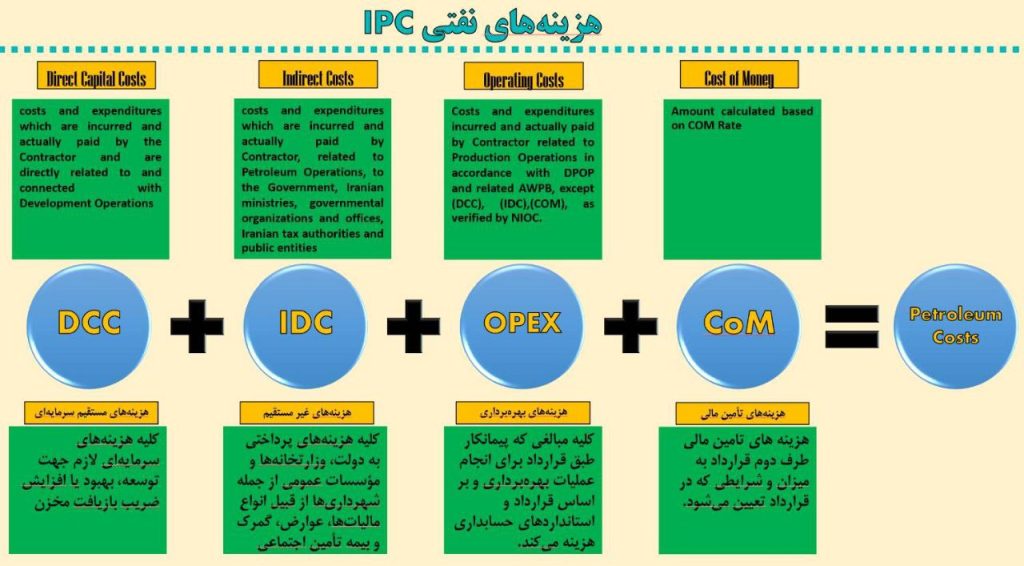

The term “Petroleum Costs” in the fiscal regime of upstream petroleum contracts refers to those costs that are related to the petroleum operations under the contract, are incurred by the contractor, and become recoverable after reaching the First Targeted Production (FTP). Recovery takes place in the following order of priority: Operation Expenses (OPEX)

Operation Expenses (OPEX)

Indirect Cost (IDC)

Indirect Cost (IDC)

Direct Capital Cost (DCC)

Direct Capital Cost (DCC)

Cost of Money (CoM)

Cost of Money (CoM)

The components of Petroleum Costs, along with their contractual definitions from the Cabinet-approved IPC Model, are shown in the accompanying diagram.

It should be noted that, in essence, these same categories of petroleum costs also existed in Buyback contracts, albeit under different terminologies.

Leave a Reply