⭕️ Why is reserves evaluation important in the first place?

Reserves evaluation is the heart of decision-making in the oil and gas industry. Nearly all key decisions—field development, investment, financing, reporting to regulatory authorities, and even asset insurance—are ultimately built around one simple question:

How much oil or gas can we ultimately produce economically?

Contrary to common perception, the answer to this question is not a single definitive number; rather, it is a range of estimates that depends on geological, technical, economic, and legal uncertainties.

⭕️ The fundamental difference between Resources and Reserves

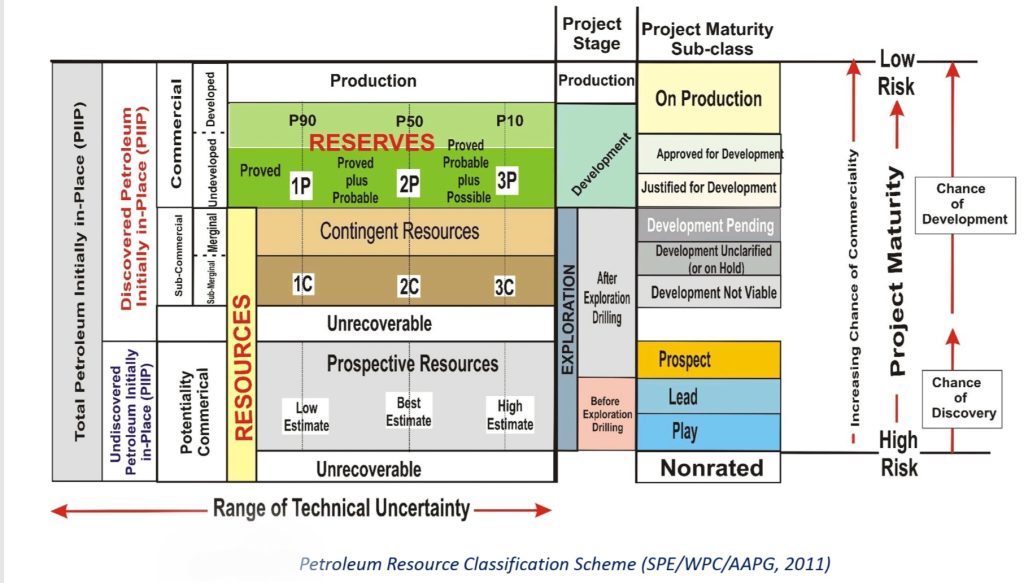

One of the most common sources of confusion is the conflation of the terms Resource and Reserve.

❌ Resources

Resources refer to all quantities of hydrocarbons that:

1. Exist in the subsurface or are expected to exist,

2. Regardless of whether they have been discovered or not,

3. Regardless of whether they are currently economic or not.

Simply put, Resources mean what may exist in nature and could potentially be recoverable. Resources themselves are divided into several categories, including:

❎ Prospective Resources: Estimated quantities of hydrocarbons in undiscovered accumulations.

❎ Contingent Resources: Discovered resources that are not currently economic or technically developable.

❌ Reserves

Reserves are, in fact, a subset of Resources and are subject to much stricter conditions. A hydrocarbon volume is considered a Reserve only if it:

1. Has been discovered,

2. Has a defined development plan,

3. Is technically recoverable and economically viable under current economic and contractual conditions.

🔰 Why are reserves not a fixed number?

Uncertainty

An oil or gas reservoir is a complex subsurface system. We never observe it in its entirety; instead, we model it using direct and indirect data.

As a result, there is always uncertainty in determining parameters such as:

Original Oil or Gas in Place (OOIP / GIIP)

Recovery Factor

Future reservoir behavior

Prices and costs

This uncertainty leads to the use of probabilistic estimates.

⭕️ Probabilistic estimates: Understanding 1P, 2P, and 3P in simple terms.

The well-known 1P, 2P, and 3P classifications are used precisely to express this uncertainty.

❎ Proved Reserves (1P):

In reservoir modeling, this corresponds to aggregating those cells for which there is more than a 90% probability of hydrocarbon presence and production.

Naturally, this is a conservative estimate, based on strong data and current economic conditions, and we are almost certain that this volume will be produced.

❎ Proved + Probable Reserves (2P):

Here, we include parts of the reservoir model that typically correspond to a 50% probability of production (P50). This estimate is considered the industry’s best estimate.

In practice, most field development planning, economic evaluations (NPV), and managerial decisions are based on 2P reserves.

❎ Proved + Probable + Possible Reserves (3P):

If we include parts of the reservoir model that have as little as a 10% probability of production (P10), the reported reserve volumes become significantly larger. This represents the most optimistic scenario.

An important point is that 2P is the basis for field development design, while 3P is useful for understanding the ultimate potential and future development scenarios. 1P, being highly conservative, is often less practical for planning purposes.

As reservoir understanding improves (through additional drilling and longer production history), uncertainty decreases and the gap between 1P, 2P, and 3P narrows.

⭕️ Why do reserves sometimes change?

A change in reserves does not necessarily imply a prior error. Reserves may change due to:

1. New reservoir data

2. Changes in oil or gas prices

3. Cost reductions

4. New technologies (horizontal drilling, EOR, gas injection, etc.)

5. Changes in contractual regimes or regulations

That is why we say:

Reserves are a dynamic concept, not a fixed number.

Leave a Reply