Oil and Gas projects, due to their large scale, the volume of goods and equipment required, and the technology and expertise involved, demand substantial capital. Accordingly, various types of contracts have been designed, some of which—such as buy-back agreements—already include financing mechanisms. However, in certain cases, contracts are concluded where the financing mechanism is separate from the project’s service/contracting agreement. In such situations, the host country’s national oil company seeks external financial facilities.

Financing upstream projects in Iran’s oil industry is no exception. The National Iranian Oil Company (NIOC), in order to carry out upstream projects and to develop and produce from oil and gas fields, requires significant financial resources. Given the large scale of capital needed, these resources cannot be fully provided from the company’s internal funds.

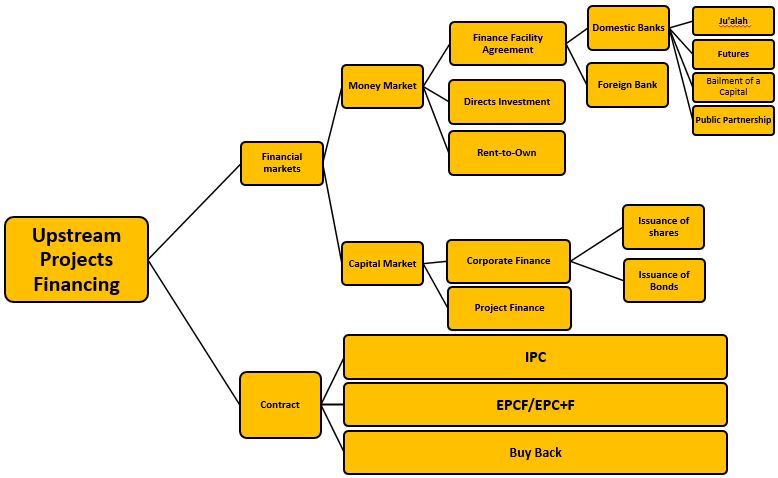

In summary, financing upstream projects can be achieved in two ways: 1. Through financial markets 2. Through upstream contracts  Financing through financial markets:

Financing through financial markets:

Financial markets are generally divided into money markets and capital markets.

– Financing through the money market broadly refers to Finance Facility Agreements (including Ju’alah, Futures, Bailment of a Capital, Public Partnership). Direct investment and Rent-to-own arrangements also fall under this category.

– Financing through the capital market is divided into two types:

– Corporate Finance

– Project Finance

Financing through upstream contracts:

Financing through upstream contracts:

Because upstream projects carry higher risks compared to downstream projects, and risk management is essential, NIOC has moved toward concluding field development contracts that also secure the necessary financing. Thus, NIOC enters into risk-service contracts that require the contractor to provide financing.

However, in some cases—such as low-risk producing fields (Brown Fields*), or due to sanctions and other limitations in attracting investors, or even to support domestic companies—NIOC may conclude contracts that only involve the obligation to perform the work, without requiring the contractor to provide financing (such as EPC contracts). In these cases, NIOC secures the necessary financing either by obtaining loans from external sources (mainly banks) or by using its internal resources.

Therefore, the employer (NIOC) has historically delegated financing to contractors through buy-back contracts (after the enactment of the Oil Law of 1987), and more recently through the new generation of Iranian upstream contracts known as IPC (following the Cabinet resolution of November 2, 2015, and subsequent amendments), or EPCF contracts.

Support measures for contractors in obtaining loans are also provided in Article 4, Note 3 of the resolution on the general conditions, structure, and model of upstream contracts: “To support Iranian exploration and production companies, the government shall prioritize them in obtaining financial facilities from banks.”

Despite the Cabinet resolution introducing the new IPC framework, it should be noted that buy-back contracts may still be used under certain conditions. Article 12 of the resolution on the general conditions, structure, and model of upstream oil and gas contracts states that, in special circumstances and when necessary, NIOC may conclude buy-back contracts with the approval of the Minister of Petroleum.

In other words, project execution under these contractual frameworks is not separate from financing. The contractor is not only responsible for implementing the project but also for financing it. Alternatively, as mentioned earlier, the employer may assume responsibility for financing and award the project under standard Engineering, Procurement, and Construction (EPC) contracts.

*Sources:

1. Shiravi, Abdolhossein; Oil and Gas Law*, Mizan Publications, 2019 2. Goodarzi, Zahra; Financing Upstream Oil and Gas Industry Projects, Mizan Publications, 2022

Leave a Reply